A Decade of Debacles: 10 Notable Product Management Clusterf***s (2015–2024)

If the last decade proved anything, it’s that “move fast and break things” scales… right up until it breaks your product, your P&L, or occasionally an airplane’s Wi‑Fi announcement. What follows isn’t schadenfreude. It’s a field guide to 10 spectacular product misfires, rich with receipts, quotes, and hard numbers so we can ship fewer face‑plants and more wins.

The window here is 2015–2024, but two entries began just before 2015 and cratered during this window. Their lessons, sadly, aged like milk.

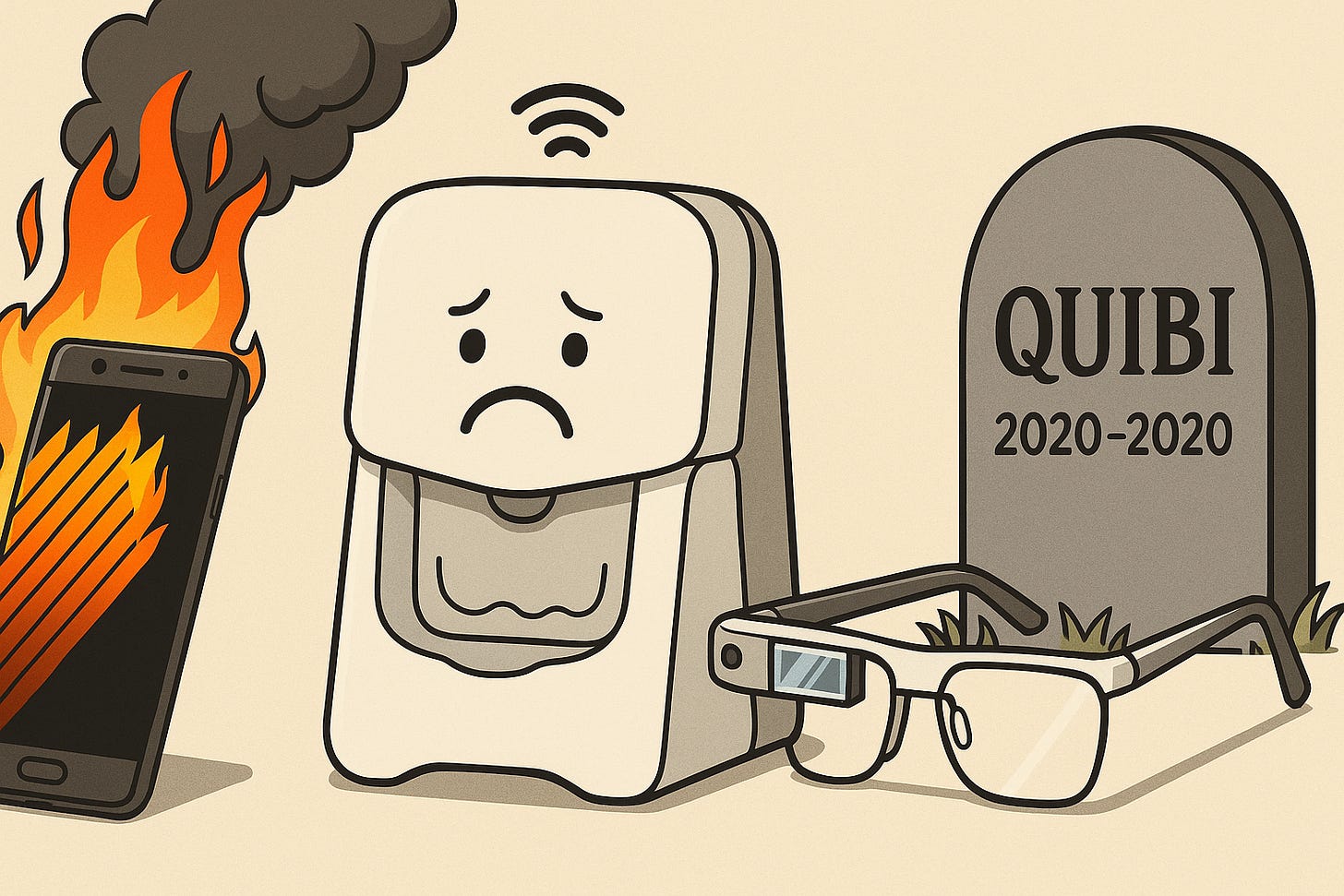

1) Samsung Galaxy Note 7 (2016): The Explosive Launch

Two recalls. 1.9 million devices in the U.S. alone. And a permanent discontinuation after replacement phones also ignited. Samsung ultimately guided ~₩3 trillion (~$3B) operating profit impact through Q1’17 (on top of a prior hit), while analysts pegged lost revenue up to $17B—plus a one‑day $20B market cap vaporization. Root cause: two different battery defects across suppliers; translation: speed beat safety. (U.S. Consumer Product Safety Commission)

“I heard those new phones were fire.” —Redditor, during the recall. (Reddit)

PM takeaways: In safety‑critical hardware, schedule is a requirement only after validation passes. Don’t duel suppliers on thin tolerances without test time; and announce with humility when lithium‑ion is involved. (Regulators literally had to tell passengers to power Note 7s off.) (U.S. Consumer Product Safety Commission)

2) Juicero (2017): The Squeezable Solution to a Non‑Problem

The $699 (later $399) Wi‑Fi juicer that squeezed proprietary pouches… which Bloomberg showed you could squeeze by hand just as well and faster. Investors poured ~$120M into a system whose core “job” didn’t exist. The company shut down 16 months after launch. (Wikipedia)

“Scan the QR code so the $400 juicer can approve your spinach.” —Reddit, still iconic. (Reddit)

PM takeaways: If your MVP can be replaced by a human hand, that’s not “disruption,” it's unit economics L. Validate the problem before you over-engineer the solution. (Also: subscriptions don’t alchemize a weak value prop.) (The Bolt Blog)

3) Google Glass (consumer) (discontinued in 2015): A Vision Too Early

$1,500 hardware, minutes‑long battery life, and a built-in PR disaster (“Glassholes”) when society was not ready for face‑mounted cameras. Google halted consumer sales in January 2015; the enterprise sequel died in 2023. Ambition was huge; the consumer value proposition and social acceptance were tiny. (Wikipedia)

“Having a camera on your face was a bridge too far for most people.” —Hacker News. (Hacker News)

PM takeaways: Some “futures” need regulatory clarity, etiquette norms, and cheap, invisible hardware. If you can’t solve privacy or stigma, you don’t have a product‑market fit - you have a sociology problem with a battery. (The Guardian)

4) Amazon Fire Phone (2014–2015): Failure to Differentiate

The phone launched at $199 on a two‑year contract, AT&T‑only in the U.S., featuring “Dynamic Perspective” 3D head‑tracking and “Firefly” product recognition. Cool demos; unclear why switch? Amazon took a $170M charge with $83M in unsold inventory; the phone was discontinued in 2015. (The Verge)

“What does it do that any Android phone doesn’t?” —HN, summarizing the shrug. (Hacker News)

PM takeaways: Platform lock‑in + carrier exclusivity + novelty features ≠ wedge into a mature market. If your core utility is “buy more from us,” consumers notice. (The Verge)

5) CNN+ (2022): A Streamer That Lived for ~30 Days

Launched March 29, 2022; shut down April 28, 2022. Reported $300M initial investment, 100–150k subs in weeks—yet <10k daily users. The merger into WBD and a “single app” strategy delivered the coup de grâce. Mis‑sized TAM + timing + portfolio strategy whiplash = curtains. (Wikipedia)

“Shutdown quicker than Quibi.” —HN, succinctly. (Hacker News)

PM takeaways: In a bundling era, “yet another subscription” must be must‑have. Know your parent‑co strategy debt; distribution and daily habits matter as much as content slate. (Ars Technica)

6) Theranos (exposed 2015): The Blood‑Testing Mirage

By 2014, Theranos hit a $9B valuation—then WSJ reporting and regulators revealed the tech didn’t work as claimed. In 2018, the SEC charged the company and Elizabeth Holmes with fraud (settled by Holmes; barred 10 years). In 2022, Holmes was convicted of defrauding investors and later sentenced to 11+ years; appeals have failed. This wasn’t a product miss; it was an ethics crater. (The Wall Street Journal)

PM takeaways: “Fake it till you make it” ends where medical diagnostics begin. Integrity is a core product requirement; so is third‑party validation before clinical claims. (TIME)

7) Facebook’s “Move Fast…” Privacy Era (2015–2019+): Growth at Human Cost

Cambridge Analytica accessed data from up to 87M users; the FTC later imposed a $5B penalty and sweeping governance changes (largest privacy fine in history). A $725M class‑action settlement followed, with payouts rolling in 2025. Facebook even retired the motto in 2014 (“…with stable infra”). Speed met externalities. (WIRED)

“If you’re not paying for it, you are the product.” —HN, evergreen. (Hacker News)

PM takeaways: Build for minimum virtuous product, not just MVP. Treat data as radioactive: collect less, protect more, audit always, and stress‑test for abuse. (Harvard Business Review)

8) MoviePass (2017–2019): Unit Economics on Fire

Dropping to $9.95/month for “one movie a day” rocketed subs past 3M by mid‑2018—and set cash on fire. The service literally ran out of money (emergency $5M loan), then yo‑yoed terms. The FTC later settled with operators over tactics like invalidating heavy users’ passwords and failing to secure data. The product was beloved; the model was fantasy. (The Verge)

“They started using shady tactics to stop power users—like changing passwords.” —HN, and the FTC backed that up. (Hacker News)

PM takeaways: “Too good to be true” is not a growth strategy; it’s a runway estimate. If your pricing depends on partners you don’t control, your LTV math is wishful thinking. (The Verge)

9) Quibi (2020): Short‑Form, Long List of Problems

Funded with ~$1.75B, launched April 6, 2020, shut down ~6 months later. The paid, mobile‑only, no‑screenshots, no‑casting model misunderstood short‑form consumption habits forged on free, share‑native platforms. Even a pandemic‑captive audience said “hard pass.” (Vanity Fair)

“As predicted by everybody who had ever heard of Quibi.” —HN, brutal. (Hacker News)

“Hilarious that they blamed Covid… your audience has nothing to do but watch videos!” —Reddit. (Reddit)

PM takeaways: Distribution and shareability are features. Locking out the social graph in 2020 was like launching a sports car without wheels. Price must reflect substitutes (free) and context (idle minutes). (Vanity Fair)

10) Apple AirPower (announced 2017, canceled 2019): The Promise That Never Materialized

Apple previewed a mat that would freely charge iPhone, Watch, and AirPods anywhere on its surface. Two years later, it was quietly canceled: “After much effort, we’ve concluded AirPower will not achieve our high standards,” said Apple hardware SVP Dan Riccio. Reporting and teardown rumors pointed to overheating from overlapping coils; engineers were boxing with physics. (TechCrunch)

“A truly ‘magical’ example of courage: promise it on stage, then cancel.” —HN. (Hacker News)

“~32 coils for x/y freedom… super complicated.” —Reddit, from someone in wireless power. (Reddit)

PM takeaways: Don’t announce multi‑constraint hardware until feasibility is proven with thermals, EMI, and watchdogs. “It works in CAD” is not a milestone; passing validation is.

Five Patterns That Keep Showing Up

Speed over safety (Note 7, AirPower): Physics is undefeated. Timelines don’t negotiate with thermal runaway. Build schedule slack for red‑team testing. (Samsung Newsroom)

Feature over fit (Fire Phone, Glass): Novelty ≠ value. Ask the switch‑cost question: What will I do now that I couldn’t yesterday? (The Verge)

Business model denial (MoviePass, Quibi, CNN+): TAM math isn’t vibes. Model the behavioral reality (free substitutes, bundling, daily habits), not just the spreadsheet. (The Verge)

Ethics and externalities (Theranos, Facebook): You can’t iterate your way out of lying or ignoring harms. Governance is a product feature. (SEC)

Over‑engineering simple jobs (Juicero): If hands beat your hardware, pivot to supply chain + brand—or stop. (Bloomberg.com)

Bonus: What Would a Good PM Have Done?

Run “reverse MVP” tests. Could a simpler substitute (hands, free TikTok, an existing bundle) satisfy most users? If yes, your differentiation must be 10x and obvious. (Snopes)

Price with physics & partners in mind. If your cost of goods sold is a movie ticket, don’t charge $9.95 for unlimited tickets and hope. Align incentives or don’t ship. (The Verge)

Pre‑mortems with real numbers. “What would have to be true” scenarios for adoption, churn, and cash burn, informed by harsh comps (free YouTube/TikTok, existing news bundles). (Ars Technica)

Ethics review as a gate. Bake in abuse‑case testing and external audits for data/health products. Privacy fines are taxes on deferred design. (Federal Trade Commission)

Clear “kill switches.” AirPower’s cancellation—however painful—was better than shipping a hotplate. Sometimes the right launch is no launch. (TechCrunch)

Closing Thought

Product management is systems thinking under uncertainty. The “failures” above weren’t random; they were predictable outcomes of incentives, blind spots, and calendar‑driven bravado. The fix isn’t cynicism—it’s better hypotheses, slower knives where it counts, and the humility to admit when the hand‑squeeze beats the hardware.

If you’ve survived to the end, congrats: you just earned a free pre‑mortem on your next launch. No QR code required.